Embracer Group to close studios and cancel games as part of restructuring

After buying half the games industry, now they're closing parts

Embracer Group, the corp who've spent several years buying up dozens of video game studios, today announced a financial restructuring that will involve closing studios, cancelling games, and laying off employees. They say this will leave them a "stronger, more efficient company". Their purchases include Gearbox, Crystal Dynamics, Volition, the rights to The Lord Of The Rings, and so many more. Embracer own 138 studios and have over 16,500 people working for them, and it's not clear how many will remain afterwards.

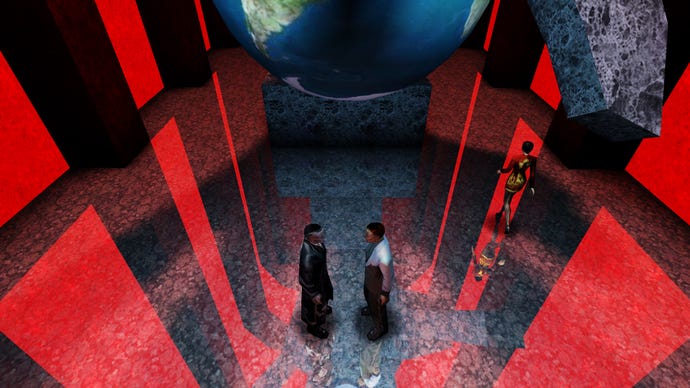

The many, many things Embracer currently own include Gearbox (Borderlands), Crystal Dynamics (modern Tomb Raider), Eidos Montreal (modern Deus Ex), Volition (Saints Row), Dambuster Studios (Dead Island 2), 3D Realms (Bombshell), Ghost Ship Games (Deep Rock Galactic), Coffee Stain (Goat Simulator and Satisfactory), Piranha Bytes (Gothic, Risen, Elex), Tripwire Interactive (Killing Floor), Warhorse Studios (Kingdom Come: Deliverance), 4A Games (Metro), Snapshot Games (Phoenix Point), Zen Studios (Zen Pinball), Bugbear Entertainment (Wreckfest), New World Interactive (Insurgency), Flying Wild Hog (Shadow Warrior reboot), Beamdog (remasters of Planescape and Baldur's Gate), Perfect World, Saber Interactive, Tuxedo Labs (Teardown), and Middle-earth Enterprises (like, actual Middle-earth). They've also bought individually bought rights to series including Alone In The Dark, Carmageddon, and TimeSplitters. And they have moved beyond games with comic book publisher Dark Horse, board game publisher Asmodee, and various companies for anime, CGI, and more.

No word yet on who and what exactly will be affected, but Embracer laid out their restructuring plan in a press release. Actions include closing some studios, cancelling some unannounced games, cancelling some announced games that have "low projected returns", focusing more on internal development with intellectual properties they own or control, and creating a more-centralised process for deciding and approving what they do make.

"I have a high degree of confidence that this entire process is going to easily translate into better product selection that's more profitable, and that gives us a greater opportunity for growth in the future, and that helps to leverage the IP that we own within our organisation. I mean, we own Lord Of The Rings," said interim chief operations officer Matthew Karch during a press conference. "We know we need to be exploiting Lord Of The Rings in a very significant fashion, and turn that into one of the biggest gaming franchises in the world. And that's obviously something that we're going to be doing. That's a much better use of resources than some of the other projects that some of our teams have been working on."

Embracer talk up independence and creative freedom for the operating groups they sort studios into, and do say their new approval process will "[maintain] creative freedom", but working in established series has always been a huge focus for them. Their website lists "over 850 franchises" as one of the company's three key stats. While they are certainly not the only games company trading on other people's former glories, a large motive in many acquisitions has seemed to be trying to buy the player loyalty, respect, and enthusiasm that others earned. Hell, Embracer Group's previous name was THQ Nordic because they bought the rights to the name of a better-respected rival after THQ collapsed. And if they close a studio, Embracer will still hold the rights to their games, able to make sequels and remasters and spin-offs and anything else they please at unrelated surviving studios.

It's hard not to be wary of Embracer's expansion and contraction when the industry at large treats players' loyalty, respect, and enthusiasm for games and companies as resources it can exploit to save money. We're swimming in subpar games with familiar names, and Embracer proudly boast of having over 850 familiar names.

Back in 2019, our Graham warned of the dangers of games industry consolidation. He explained the ways it made studios and people vulnerable to the financial fates of parent companies, and the ways it might impact their creativity. In retrospect, the current wave of consolidation had barely even started at that point. Microsoft's latest move is trying to buy Activision Blizzard for $69 billion (a deal which the FTC just moved to pause) and Embracer went on to buy dozens more studios.

Embracer Group CEO Lars Wingefors said in an open letter today that their restructuring plan "will transform us from our current heavy-investment-mode to a highly cash-flow generative business this year," reducing debt and risk. Basically, they've spent years buying things, and now they need them to make money. This comes three weeks after Embracer announced that a deal which would have brought them at least $2 billion over six years had fallen through.

"Throughout each phase and wherever possible, we will work to ensure that affected team members receive information first," Wingefors said. "Where we can, we will try to provide opportunities for our colleagues to transition onto other projects. It's important to note that while we are removing roles in some companies, we will continue to hire in others."

Crystal Dynamics, at least, say that this won't impact their work with Microsoft on a new Perfect Dark or the new Tomb Raider they're making for Amazon. Hopefully we won't have to figure everything out by a process of elimination. Best of luck to everyone at Embracer.